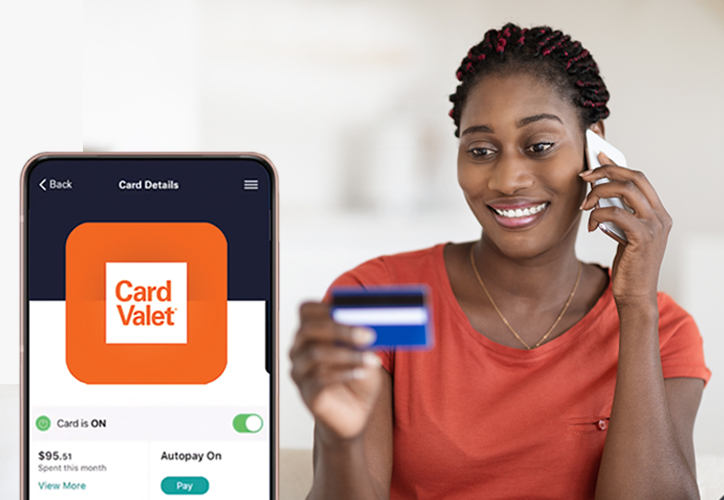

Control and monitor debit card usage anywhere, anytime using your smartphone. CardValet®, a mobile card management application offered by Collinsville Bank – A Division of Northwest Community Bank and its Divisions, gives you more control and security when using your debit card. Help protect and manage your accounts from fraud with CardValet® by setting customizable real-time interactive alerts and controls that allow you to identify unauthorized or suspected fraudulent activity as it occurs.

CardValet® Debit Card Management at Your Fingertips

Help protect yourself from debit card fraud. Manage purchases with the app with real-time alerts.

Benefits of using the CardValet® App

Manage your finances while guarding against fraud by using the latest version of the CardValet app:

- Turn your debit cards on and off

- Establish transaction controls for dollar amount limits, merchant categories and geographic locations

- Receive alerts when your debit card is used, approved or exceeds the transaction limit set by you

- Stay informed of potential fraud with alerts on attempted and declined transactions

- Get real-time balances for your accounts

SECURITY

Turn your cards on or off, in an instant, for any reason.

CONTROL

Control transactions by category or by dollar amounts.

FLEXIBILITY

Easily set, customize and modify purchase alerts.

How To Download and Start Using the CardValet® App

To get started, download the latest version of the CardValet® app by clicking the App Store button (for iOS users) or the Google Play button (for Android users) below. Complete the registration process to link your cards to the app. Next, enter your card number and once your eligibility is confirmed, you will be asked to answer a few security questions to verify your identity.

CardValet® FAQs

Below are some frequently asked questions. For additional assistance, contact your local branch.

GENERAL

What is CardValet? What does it do?

CardValet is an app that allows you to control when and how your card is used. Additionally, the app allows you to set up alerts based on spend limits and merchant type. The app also gives you the ability to turn your card off and on in the event it is lost or temporarily misplaced.

Is there a charge for using the CardValet service?

CardValet is a free app that will give you the freedom of controlling when and how your card is used. Standard data rates may apply.

Does CardValet work on Android phones and iPhones?

Yes. CardValet works with the most recent mobile operating software as well as two past generations of Android and iPhone devices.

Does CardValet work for ATM cards?

No, CardValet does not work for ATM cards.

How long does the app stay logged in if you don’t log out?

The app automatically logs you off in 10 minutes.

How will I know if there are changes or updates to the app?

Updates will show on your phone where they usually appear.

REGISTRATION

How do I get started with CardValet?

To register, select New User and enter your full 16 digit debit card number. Then enter the card’s security code, expiration date and billing address, plus the last 4 digits of your Social Security Number. Accept Terms and Condition and Privacy Policy. You’ll then be asked to create an account with a username and password and redirected to the Login screen.

What happens if I forget my password?

A token request will be sent to you via the email address entered when creating your CardValet account. If you don’t receive this email within 5-10 minutes, check your spam and junk folders.

What are the CardValet password requirements?

CardValet passwords must be at least eight (8) characters in length. They must also contain at least: one (1) upper case character, one (1) lower case character, one (1) number and one (1) special character.

Can multiple cards be linked to one registered CardValet account?

Yes; cardholders can register multiple cards within a single CardValet App. Additional cards can be added within the “Settings – Add Card” screen.

How many cards can I register within a single CardValet application?

There is no limit.

When I receive a reissued or replacement card, will I have to update their cards within the application?

If the card number is new, then the user must “add” the new card number to the user’s profile. In addition, the user may delete the old card by accessing Settings > Manage Accounts.

What should I do if my card becomes lost or stolen?

If your card should become lost or stolen, you can use your CardValet app to turn your card off immediately to prevent fraud. However, you will still need to contact the bank as soon as possible in order to complete the process of closing the card and having a new card issued.

If a parent registers a card for a child, what stops the child from changing the controls placed on the card?

Each person who registers a card will have access to controls and alerts for the card. In many cases, the child will not know about CardValet unless the parent shares the information.

What's the purpose of assigning a primary device? Can I make changes to the settings from the non-primary devices?

The primary device is used to track the GPS for “My Location” alerts and controls. All merchant and threshold alerts will be sent to the primary device. All devices that have registered a particular card can view or change the CardValet settings for that card. Controls (including the “On/Off” setting) are set at the card level. The last update to a control will be honored regardless of which phone was used to make the change. Alerts are set at the device level, so each primary device will receive alerts that were set up from that particular device. The primary device can be re-set by accessing “Settings – Primary Device.”

CONTROLS & ALERTS

What exactly is the range of the "My Location?" controls, and will this control setting impact internet transactions?

The My Location controls and alerts ensures the merchant location is within a five (5) mile radius of the “primary” device within CardValet. These controls impact “card present” transactions only, therefore internet transactions are not impacted.

If My Location is set but the primary device is off, will transactions get denied outside of the My Location area?

CardValet ignores location information that is more than one (1) hour old. For example, if the phone is off for more than an hour My Location controls will not take effect. The transaction will not be denied on the basis of the old location information.

What happens if My Location is set but the phone is left at home? Will transactions be denied outside the My Location area?

CardValet performs a proximity check at the granularity of zip code or city. If the merchant is close to home then the transactions will still go through.

Can I block all international transactions?

Yes. International transactions can be blocked using the “International” location control. Transactions will be limited to the United States.

A region has been set on the map. Does this mean the card can only be used exactly in this region?

The region shows the approximate area where the card can be used. CardValet can typically map the transaction down to a zip code or city. If the city or zip code of the merchant overlaps with the selected region in the map, then the transaction can still go through. There are instances where a merchant location cannot be mapped down to a zip code or city. If this happens, CardValet will default to a state-level match.

Will location controls, merchant controls, threshold controls, and turning the card “Off” impact previously authorized recurring transactions?

Previously authorized recurrent payments will continue to process and will bypass the CardValet edit checks.

How long does it take for a control or alert setting to take effect?

Control settings take effect as soon as the “Updating information” message in the app stops.

How do I turn off notifications at certain times such as when I’m sleeping?

The user can set the “Do Not Disturb” time that will suppress notification during the set times. Some notifications will still be delivered, for example any transaction denial or any transaction that is a card-present authorization. The user can also disable ALL alerts by going through the card alerts drop down box.

Are the alerts sent as email or “push” notifications to the device?

CardValet alerts are sent as push notifications to the phone. The alerts also display under “Messages” in the CardValet App.

If I have set an alert for international transactions and no controls are set, will I receive alerts for all international transactions regardless of whether the transaction is blocked or successful?

Yes, an alert is generated regardless of whether or not a control preference is set.

If I set multiple alerts and a transaction violates these alerts will I receive a separate message for each alert?

No, the alerts are consolidated into one message.

Can I turn the low balance alert off?

The low balance alert is controlled on a cardholder level. It cannot be turned off by Collinsville Bank – A Division of Northwest Community Bank.

TRANSACTIONS

Does the app show recent transaction history?

Yes, the app shows the last 50 card-based transactions posted within the last 30 days.

A threshold limit of $50 has been set but the user can’t fill gas in some stations. Why?

There are some merchant types where a merchant will pre-authorize the card for an amount. It’s possible that it may be larger than the actual transaction amount. In this instance the pre-authorization amount must meet the threshold spend limit.

What type of transactions display in CardValet?

CardValet only shows the transactions that are performed with the card. For example, it does not show teller transactions or bill pay on an account.